In-Depth

Microsoft's Bet on a Blockchain Future

Microsoft has emerged as a leading force behind the rise of enterprise blockchain networks with a formative portfolio of new and forthcoming services in Azure. Learn how these cryptographically hashed distributed ledgers could change how transactions are processed.

At a recent event showcasing a variety of customers using Microsoft's software and cloud services to transform traditional business processes, one could be forgiven for overlooking the modest booth staffed by Ann McCormick. While the Steelcase modern office environment and Hershey's IoT-enabled analytics solution may have overshadowed her demonstration visually, McCormick described how one of the world's largest banks has piloted Microsoft's Blockchain as a Service (BaaS) on Azure to automate the letter-of-credit application process. McCormick, director of trade and supply chain finance at Bank of America Merrill Lynch, explained how using blockchain helped automate the now-cumbersome credit application and verification process.

The demonstration is the latest example of a growing number of large organizations trialing emerging networks and applications based on blockchain, the technology that powers peer-to-peer distributed digital-token-based transactions such as bitcoin. McCormick showed a business-to-business transaction between Microsoft's Treasury services division, the bank and a prototypical customer referred to as Nerdy Handbags. McCormick said that the pilot validated the potential for blockchain to eventually replace the traditional, time-consuming and costly paper-based letter-of-credit application process that involves a number of third-party verification processes including SWIFT banking transactions. The use of Microsoft's BaaS provided an alternatively secure, digitized credit application flow through the electronic interchange of documents and funds, McCormick explained. McCormick shares a rapidly growing view that as the technology matures over the next year or two, that blockchain networks can significantly simplify and reduce the cost associated with applying for credit in a business-to-business transaction involving more than two parties.

"You can see how powerful it is to have transparency for all of the parties in this scenario," McCormick said in an interview. While she said there are no immediate plans to put the piloted scenario into production, it gave credence to the concept of issuing a letter of credit using a blockchain-based smart contract running on Azure. "We are working on what our next steps are," she said. "We do see the opportunity and we are partnering very closely with the Microsoft Treasury team. We are very anxious to get this process streamlined."

The bank and Microsoft jointly announced the pilot in September 2016 saying that by digitizing transactions over blockchain networks, the resulting automation can shrink settlement times, by securely applying the business logic to associated data resulting in reduced risk among counterparties, improved transparency and, hence, more predictable working capital. McCormick was joined at the demo in late April by Marley Gray, Microsoft's principal program manager for Azure blockchain engineering. While Bank of America is one of the world's largest financial institutions, it's just one of a growing cadre of large customers who have incubation efforts that are using Microsoft's emerging blockchain portfolio. Though still in its early stages, Microsoft's BaaS on Azure has rapidly evolved over the past two years from a blueprint to an extensive set of new tools and capabilities and is on a path for further buildout in the coming months.

Planting the Seeds

Gray, who had previously worked with Microsoft's financial services customers, introduced the company's push into blockchain with the launch of its BaaS on Azure in November 2015. At the time, Microsoft's blockchain launch appeared speculative to many who saw IBM Corp. and a growing number of players and startups with cryptocurrency tools, as having an edge with the major banks, many of which already were engaged in blockchain development projects. Nevertheless, given the early stage of the technology and the still-unfolding standards, business processes, governance and regulatory environment that will take many years to form, there's ample room, and the expectation that there will be a large number of players offering various blockchain capabilities.

Microsoft is in good company among the major cloud providers, software companies, and large global consulting and systems integration firms that have substantial R&D efforts. These companies see the potential for blockchain to disrupt how transactions are processed by replacing the notion of a centralized database and ledger with one that's a write-once and read-many database, meaning it provides immutable record of every transaction. Because every transaction is read-only, unlike traditional databases, they can't be changed or erased, ensuring their integrity, particularly those using crypto-token-for-funds transfer.

In less than two years since the release of BaaS on Azure, a name Gray now regrets, it has risen from a development and test bed among a slew of emerging offerings to one of the leading providers of blockchain infrastructure, along with IBM and Amazon Web Services Inc. (AWS). It will be many years before blockchain networks provided by Microsoft and others are mature enough to touch mainstream IT, but CEOs and CIOs of large global companies across industries are bullish on its potential, even if they're not clear to what extent or in what precise form. Almost every major organization that conducts large numbers of transactions are either conducting pilots with what's available or looking to understand its role, according to analysts, IT providers and the largest consulting firms.

Formative as it now is, Gartner Inc. recently predicted there will be at least one large blockchain network with a $10 billion value by 2022 and by 2025 the business value created by blockchain will exceed $176 billion surging to $3.1 trillion by 2030. Despite such lofty long-term projections, on a more simplistic level, analysts say blockchain is generating significant curiosity among CIOs across multiple industries and is one of the fastest-growing search terms on Gartner's Web site. That doesn't surprise Gray. The interest in blockchain transcends banks -- it can disrupt various industries from health care and energy, to retail and virtually any business that conducts high volumes of database transactions or has a complex supply chain. "There's a combination of greed and fear," Gray tells Redmond magazine. "There is an opportunity to knock out that middleman where I can do things on a peer-to-peer basis and I can start moving into other areas such as tying a supply chain into finance. You tie those things together and offer advanced services like lower credit, better credit terms for buyers or sellers, and you can offer incentives for paying earlier, delivering early and have it automatically execute new things like that."

Embracing Ethereum with ConsenSys

Microsoft's rapid rise in the race to accelerate blockchain followed its decision in 2015 to partner with ConsenSys, a startup whose Solidity programming language was designed to write distributed ledgers built with programmatic smart contracts on blockchain networks that target the open source Ethereum-based virtual machine. "Smart contracts offer a lot of promise to create intelligent systems with self-enforcing contracts to allow business processes to operate independently," Gray explained in a white paper

posted on GitHub

last year. Ethereum is a blockchain topology like bitcoin, though it's more than just a digital currency. It provides the peer-to-peer platform designed to let developers build decentralized database applications. Gray described the introduction of the Ethereum Blockchain as a Service (EBaaS) on Azure as a service for enterprises and third parties. By bringing the ConsenSys Solidity to its Visual Studio tooling suite, Gray described the new offering as a "single-click cloud-based blockchain developer environment." The initial offering consisted of two tools for rapid development of smart contract-based applications. Ether.Camp is an integrated developer environment and BlockApps is described as a private, semi-private Ethereum blockchain environment designed for deployment into a public Ethereum blockchain network.

In describing Microsoft's decision to build its Azure blockchain service on Ethereum, Gray at the time explained that it "is open, flexible and can be customized to meet our customer's needs, allowing them to innovate and provide new services and distributed applications, or Dapps. Ethereum enables Smart Contracts and Dapps to be built, potentially cutting out the middleman in many industry scenarios, streamlining processes like settlement. But that's just scratching the surface of what can be done when you mix the cryptographic security and reliability of the blockchain with a Turing-complete programming language included in Ethereum, we can't really imagine what our customers and partners will build."

At the same time, Gray emphasized the purpose of its EBaaS offering was to provide a low-cost and ready-made dev-test-production offering to create public, private and consortium-based blockchain networks. Gray also noted the ability to tie in Microsoft's other cloud services including Cortana Analytics (machine learning), Power BI, Azure Active Directory (Azure AD), Office 365 and Dynamics 365 to create new decentralized and cross-platform applications. Another benefit of Ethereum is that all transaction processors, also known in the cryptocurrency world as miners, come to consensus about the series of events regarding the transport and storage of an ether token's value, as well as agreeing on the processing that occurs among shared programs on the Ethereum World Computer, a process that occurs approximately every 15 seconds. Gray described other attributes of Ethereum in his initial post.

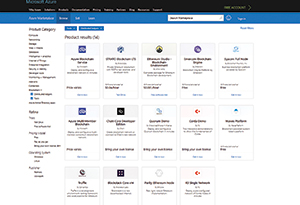

One month after the launch, Gray said a number of customers were already using the offering, and added new packages to the Azure marketplace: Go Ethereum on Ubuntu, a VM deployment tool running BlockApps Strato, and a variety of other packages for financial services firms, including C++ Ethereum, Ethereum on Windows Server, and support for Ripple, a blockchain-based settlement network. Also added were Eris Industries, a platform to build smart contracts for industrial applications; OpenChain, an open source distributed ledger; and Factom, designed to simplify records management and address security and compliance. Gray consistently announced new tools into the Azure marketplace -- at last count there were 14 (see Figure 1).

[Click on image for larger view.]

Figure 1. A view of the blockchain tools available in the Azure Marketplace.

[Click on image for larger view.]

Figure 1. A view of the blockchain tools available in the Azure Marketplace.

Aside from Gray's updates, Microsoft had taken a relatively low-profile posture with its blockchain efforts until it held its Envision conference in New Orleans last year, where CEO Satya Nadella gave a nod in his keynote address to Microsoft's blockchain efforts, buoyed by the news that the R3 consortium of 40 of the world's largest banks, including Barclays, Credit Suisse, HSBC, Royal Bank of Scotland, Citibank, Bank of America and Wells Fargo (it now consists of 70), would run their blockchain proof-of-concept settlement exchange on the Azure-based service. R3 had also run pilots on IBM Bluemix and on AWS.

"Azure emerged from the tests as the preferred cloud provider for R3 and its consortium because of its flexible, open, and comprehensive set of enterprise-grade grade services, including Internet of Things (IoT), advanced analytics, machine learning algorithms, security features, and developer tools," Gray said at the time. Microsoft's blockchain team continued to roll out new services last year, including the first version of infrastructure services, code-named "Project Bletchley," available in the Azure Resource Manager. It addresses requirements such as scale, performance, support for identity (including Azure AD), key management, privacy, security, operations management, and support for Azure's various services, including machine learning and analytics, reporting, and integration with the blockchain services in Azure and other networks.